LEASE

Published on October 7, 2021

EXHIBIT 10.1

LEASE

THIS LEASE ("Lease") is made this 5th day of October, 2021 (the "Effective Date"), by and between MERCHANTS ICE II, LLC, a Texas limited liability company (hereinafter referred to as "Landlord") and SCORPION BIOLOGICAL SERVICES INC., a Delaware corporation (hereinafter referred to as "Tenant").

WHEREAS, Landlord is the owner of a certain parcel of real property located at 1305 E. Houston Street, San Antonio, Texas 78205 as more particularly described in Exhibit "A", which real property is improved by two office buildings and shall be further improved by additional structures and development in the near future, commonly known as the Merchants Ice Building(s) (collectively referred to herein as the "Complex", including the buildings, improvements and underlying and adjacent land); and

WHEREAS, Texas Research and Technology Foundation and Tenant executed that certain Donation Agreement (as used herein, so called) of even date herewith;

WHEREAS, Landlord and Tenant intend the Donation Agreement continue to be in effect during the period of time that the Lease is in effect until the terms of the Donation Agreement are satisfied, it being understood and agreed that an Event of Default (as defined in the Donation Agreement) is an Event of Default under this Lease;

WHEREAS, Tenant desires to lease space in the Complex and Landlord is willing to lease Tenant space in the Complex, upon the terms, conditions, covenants and agreements set forth herein.

NOW, THEREFORE, the parties hereto, intending legally to be bound, hereby covenant and agree as set forth below.

| 1. | THE PREMISES |

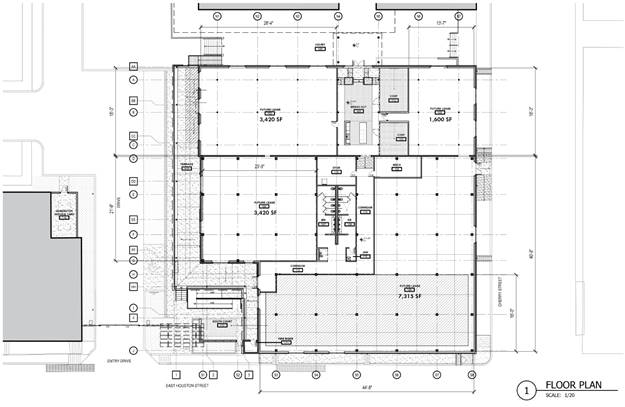

Landlord hereby leases to Tenant and Tenant hereby leases from Landlord for the Term (as defined below) and upon the terms, conditions, covenants, and agreements hereinafter provided, the space (the "Premises") that is currently estimated to be 20,144 square feet of rentable area (the "Premises Rentable Square Feet"), which in any event constitutes the entire rentable area of the structure known as the "Music Building" that is located within the Complex. The Premises are labeled as "Scorpion 20,144 SF" on Exhibit "B" attached hereto and made a part hereof. The Lease of the Premises includes the non-exclusive right of Tenant to use, in common with others and in accordance with the Rules and Regulations attached as Exhibit "D", those certain areas (the "Common Areas") and facilities of the Complex which are from time to time provided and designated by Landlord for the use of tenants of the Complex and their employees, clients, customers, licensees and invitees or for use by the public, which facilities and improvements include any and all corridors, foyers, vending areas, bathrooms, electrical and telephone rooms, mechanical rooms, janitorial areas, kitchens, conference / meeting rooms, and other similar facilities of the Complex and any and all grounds, parks, landscaped areas, outside sitting areas, sidewalks, courtyards, walkways, and generally all other improvements located in the Complex that are not the subject of an exclusive lease. Landlord agrees to maintain such Common Areas in good order and condition consistent with other Class-A office building projects in San Antonio, Texas, normal wear and tear excepted, and subject to Landlord’s right to charge the tenants of the Complex for Operating Expenses as outlined in this Lease. Landlord further covenants during the term of this Lease that the Common Areas shall at all times include (subject to temporary closure for routine repair and maintenance) Tenant access to a kitchen area on the Complex that is comparable to or better than the kitchen facilities which exist as of the Effective Date.

| 1 |

| 2. | USE OF PREMISES |

Tenant will use and occupy the Premises solely for general office, laboratory, research, analytical, and/or biomanufacturing purposes, subject to Applicable Laws (as hereinafter defined); without the prior written consent of Landlord, the Premises will not be used for any other purpose, including any use set forth in Section 50 of this Lease. Without limiting the foregoing: (a) Tenant may utilize the Premises to perform the daily requirements of a large molecule CRO focusing on the underserved market of Immuno-assay, biomarker, CLIA and GMP manufacturing; (b) Tenant may focus its efforts initially on the areas of Bioanalytical (Immuno-Assay, Cell Based Assays, Biomarker Support), Diagnostics (developing a clinical diagnostic assay for another CPRIT company for patient stratification for their Phase III pivotal trial (Luminex); and (c) Tenant may initiate plans for the build out of a CLIA regulated facility to support the implementation of a companion diagnostic for Ovarian Cancer, and Biological Manufacturing (Small scale process development and production of GMP material to support IND, Phase I/II clinical trials). Tenant will not use or occupy the Premises for any unlawful purpose, or for any purpose that will constitute a nuisance under applicable law, and will comply with all present and future laws, ordinances, regulations, and orders of the United States of America, State of Texas, Bexar County, and any other governmental authority having jurisdiction over the Premises ("Applicable Laws").

| 3. | TERM |

The Term (as used herein, so called) of this Lease shall be for a period of one hundred eighty (180) full calendar months commencing on the Lease Commencement Date (as hereinafter defined), plus any partial month from the Lease Commencement Date to the end of the month in which the Lease Commencement Date falls, ending at 11:59 p.m. local time on the last day of the 180th full calendar month following the Lease Commencement Date (the "Lease Expiration Date"), subject to adjustment and earlier termination as provided in this Lease. The initial period of time referenced in the preceding that comprises the Term is the "Initial Term".

| 3A. | LEASE COMMENCEMENT DATE |

The "Lease Commencement Date" is the date on which Landlord delivers the Premises to Tenant with the Lease Improvements and Tenant Improvements (as defined in Exhibit "C" hereto) having achieved Substantial Completion (as defined in Exhibit “C”, attached hereto) (such date being referred to herein as the "Delivery Date"), but not later than December 1, 2022 (the “Outside Deadline”), certified as fully complete by the Architect (as hereinafter defined). If the Lease Commencement Date does not occur prior to the Outside Deadline, Tenant shall be entitled to the sum equivalent to the remaining Basic Rent payment after the application of the Basic Rent Abatement set forth in Section 4.C. below, for each full or partial calendar month after the Outside Deadline that the Lease Improvements and Tenant Improvements have not achieved Substantial Completion, to be paid in the form of a rent abatement in the amount of the then-applicable monthly Basic Rent (prior to application of any abatement) per partial or whole calendar month following the Outside Deadline in which the actual Lease Commencement Date occurs. If permission is given to Tenant to enter into the possession of the Premises (other than to perform the Tenant Improvements (as defined in Exhibit “C”) therein prior to the specified Lease Commencement Date and Tenant actually takes possession of the Premises, Tenant covenants and agrees that such occupancy shall be deemed to be under all the terms, covenants, conditions and provisions of this Lease and that the Lease Commencement Date shall occur as of the date that Tenant takes possession of the Premises for manufacturing or otherwise regardless of whether Substantial Completion has been achieved and/or a Certificate of Occupancy has been obtained.

| 2 |

| 4. | RENT |

Tenant shall pay as rent for the Premises the following amounts as more fully described in Sections 4.A. and 4.D. (each of which shall be considered Rent and all of which are collectively referred to herein as "Rent"):

A. Basic Rent. Subject to the provisions of Section 4.B. and 4.C., below: (1) The Basic Rent (hereinafter called the "Basic Rent") shall be Six Hundred Four Thousand Three Hundred Twenty and No/100 Dollars ($604,320.00) annually for the first twelve calendar months of the Lease (each, a "Lease Month"), payable in equal monthly installments, in advance, of Fifty Thousand Three Hundred Sixty and No/100 Dollars ($50,360.00), subject to the terms of the following sentence, the first payment to be made on or before the Lease Commencement Date, and each subsequent monthly payment to be made on the first day of each and every calendar month during the Term hereof; and (2) The Rent shall be considered late and subject to penalty if not paid ten days after the applicable due date. If the Term of this Lease begins on a date other than on the first day of a month, or ends on a date other than the last day of a month, Rent for the month of such termination or commencement shall be prorated at the rate of one-thirtieth (1/30th) of the fixed monthly rental for each day, payable in advance.

B. Basic Rent Escalation. On the first business day of the first full month after the anniversary of the Lease Commencement Date during the Term of the Lease, the Basic Rent for such month and the following eleven calendar months shall be increased by three percent (3%) per annum from the Basic Rent previously in effect. For the avoidance of doubt, the Basic Rent for the Initial Term as follows:

|

Lease Months (following the Lease Commencement Date and any partial month after the Lease Commencement Date prior to the first full calendar month of the Term) |

Annual Basic Rent | Monthly Basic Rent |

| 1-12 | $604,320.00 | $50,360.00 |

| 13-24 | $622,449.60 | $51,870.80 |

| 25-36 | $641,123.09 | $53,426.92 |

| 37-48 | $660,356.78 | $55,029.73 |

| 49-60 | $680,167.48 | $56,680.62 |

| 61-72 | $700,572.51 | $58,381.04 |

| 73-84 | $721,589.68 | $60,132.47 |

| 85-96 | $743,237.37 | $61,936.45 |

| 97-108 | $765,534.50 | $63,794.54 |

| 109-120 | $788,500.53 | $65,708.38 |

| 121-132 | $812,155.55 | $67,679.63 |

| 133-144 | $836,520.21 | $69,710.02 |

| 145-156 | $861,615.82 | $71,801.32 |

| 157-168 | $887,464.29 | $73,955.36 |

| 169-180 | $914,088.22 | $76,174.02 |

C. Basic Rent Abatement. Notwithstanding anything above to the contrary, Landlord hereby agrees to abate Tenant's obligation to pay Tenant's monthly Basic Rent for the first twelve (12) full months following the Lease Commencement Date (the "Abatement Period"), in the amount of Ten Thousand Nine Hundred Eleven and 33/100 Dollars ($10,911.33) per month, for a total of One Hundred Thirty Thousand Nine Hundred and Thirty-Six No/100 Dollars ($130,936.00) (the "Basic Rent Abatement"). During the Abatement Period, Tenant shall still be responsible for the payment of all other monetary obligations under the Lease, including without limitation, the remainder of the Basic Rent, which shall be Thirty-Nine Thousand Four Hundred and Forty-Eight 67/100 Dollars ($39,448.67) per calendar month. If Landlord terminates this Lease prior to the initial Lease Expiration Date due solely to the default of Tenant hereunder, then as a part of the recovery set forth in Section 16 of the Lease, Landlord shall be entitled to the recovery of the Basic Rent Abatement.

| 3 |

D. Additional Rent. During the Term, Tenant shall pay Additional Rent (as used herein, so called), which consists of the Tenant’s Share (as hereinafter defined) of Operating Expenses and Taxes. Tenant shall make such payments as set forth in Sections 4.G and 4H, below.

E. Tenant's Share. The term "Tenant's Share" means: (1) 100% of the Taxes (as hereinafter defined) attributable to the Premises; plus (2) 100% of the Operating Expenses incurred by Landlord solely with respect to the Premises; plus (3) 33.57% of the Taxes (as hereinafter defined) of the Common Areas of the Complex; plus (4) Except as included in Section 4.E.2, 33.57% of the Operating Expenses (as hereinafter defined) of the Complex, which percentages in Section 4.E(3)-(4) are obtained by dividing (a) the Premises Rentable Square Feet as stated above by (b) the Complex Rentable Square Feet as of the Effective Date.

F. Stipulations. Landlord and Tenant stipulate that the Premises Rentable Square Feet and the Complex Rentable Square Feet set forth above are conclusive and shall be binding upon them during the Term. If, during the Term, any change occurs in either the Premises Rentable Square Feet or the Complex Rentable Square Feet, Tenant's Share shall be adjusted, effective as of the date of such change occurred. provided, however in no event will the Complex Rentable Square Feet for the purpose of calculating Additional Rent in Section 4.D.1 be greater than the amount set forth in Section 4.D.1 above, or will Tenant’s Share in Section 4.E.1 above be greater than 33.57% (although Tenant's Share in Section 4.E.1 may decrease if the Complex Rentable Square Feet increases).

G. Taxes. For each year during the Term of this Lease, Landlord shall submit to Tenant a statement of the Taxes that are actually assessed by the Bexar County Tax Assessor and within thirty (30) days after receipt of such statement, Tenant shall pay to Landlord, subject to the terms of Section 4.D and 4.E, above, that portion of Additional Rent that consists of Tenant’s Share of Taxes (and, for any partial calendar year after the Lease Commencement Date, Tenant shall be responsible only for remitting to Landlord a pro-rated portion thereof, based on the number of actual days in the calendar year: (1) after the Lease Commencement Date until the end of such year; and (2) prior to the Lease Expiration Date). The termination of this Lease shall not affect the obligations of the Landlord and Tenant pursuant to this Section 4.G to be performed after such termination, but shall be effective only with respect to the period of time that constitutes the Term.

As used in this Lease, the term "Taxes" means taxes, assessments, and governmental charges or fees whether federal, state, county or municipal, and whether they be by taxing districts or authorities presently taxing or by others, subsequently created or otherwise, and any other taxes and assessments (including non-governmental assessments and charges under any restrictive covenant, declaration of covenants, restrictions and easements or other private agreement that are not treated as part of Operating Costs) now or hereafter attributable to the Complex (or its operation), excluding, however, penalties and interest thereon and federal and state taxes on income. Notwithstanding the foregoing to the contrary, in no event shall "Taxes" be deemed to include any franchise, margin, estate, inheritance, or income tax. Taxes shall include reasonable costs of consultants retained in an effort to lower taxes and all costs incurred in disputing any taxes or in seeking to lower the tax valuation of the Complex, but only to the extent actual savings results from such efforts.

H. Payment of Operating Expenses. Prior to January 1 of each year, or as soon thereafter as practicable, during the Term of this Lease, Landlord shall provide Tenant a good faith projection of Operating Expenses for the coming year, and commencing on January 1 of each year, Tenant shall pay monthly, one-twelfth (1/12) of the Tenant’s Share with respect to the Operating Expenses of operating the Complex that are set forth in Section 4.E.3. Landlord shall, within the period of ninety (90) days (or as soon thereafter as possible) after the close of each calendar year, provide Tenant a statement of such year's actual Operating Expenses with respect thereto. Tenant shall pay Landlord within thirty (30) days of statement receipt Tenant’s Share of the difference, if any, if the actual Operating Expenses was in excess of the projected Operating Expenses. If the projected Operating Expenses exceeded the actual Operating Expenses, Landlord shall refund Tenant’s Share of the excess to Tenant within ten (10) days after such determination is made or, if requested by Tenant, credit such excess against the next monthly installment(s) of Rent thereafter payable by Tenant.

| 4 |

I. Definition of Operating Expenses. The term "Operating Expenses" as used herein shall mean all reasonable and necessary expenses, costs and disbursements (but not: (x) specific costs billed to specific tenants; or (y) replacement of capital investment items, except as set forth in Section 4.I.vii, below) which Landlord incurs in connection with the ownership, operation, and maintenance of the Complex and performance of Landlord’s obligations under this Lease, in each case, determined in accordance with sound accounting principles consistently applied, without duplication, including the following costs:

| i. | Wages and salaries of the building manager and all employees below the grade of building manager engaged in operating and maintenance or security of the Complex, including taxes, insurance and benefits relating thereto. |

| ii. | All supplies and materials used in operation and maintenance of the Complex. |

| iii. | All utilities including surcharges for the Complex, the cost of water, sewer, gas and electricity, if not separately metered to Tenant (but not metered or submetered utilities paid by other tenants). |

| iv. | All heating, lighting, air conditioning and ventilating of the Complex, if not separately metered to Tenant or other tenants. |

| v. | Cost of all maintenance and service agreements for the Complex and the equipment therein, including but not limited to security, landscape, irrigation, IT, trash removal, music, energy management services, window cleaning, elevator maintenance (if applicable) and janitorial service (except with respect to replacements that are capital in nature which shall be calculated and allocated as provided for herein). |

| vi. | Cost of all insurance relating to the Complex, including the cost of casualty and liability insurance applicable to the Complex and Landlord's personal property used in connection therewith. |

| vii. | Cost of repairs, replacements, and general maintenance (excluding repairs and general maintenance paid by proceeds of insurance or by Tenant or third parties, alterations attributable solely to tenants of the Complex other than Tenant, and replacements that are capital in nature which shall be calculated and allocated as provided for herein). |

| viii. | The costs of any additional services provided by Landlord in the prudent ownership, service, repair, management, maintenance, and operation of the Complex, except as expressly excluded under this Lease. |

| ix. | The cost of any capital improvements made to the Complex after the Lease Commencement Date that, in Landlord's reasonable judgment, reduces other operating expenses such as lighting retrofit and installation of energy management systems but only to the extent these capital expenditures result in a reduction of Operating Expenses, as amortized in accordance with sound real estate accounting principles consistently applied, as well as capital improvements made in order to comply with any Law hereafter promulgated by any governmental authority, or any amendment to or any interpretation hereafter rendered with respect to any existing Law that have the effect of changing the legal requirements applicable to the Complex from those currently in effect, as amortized in accordance with sound real estate accounting principles consistently applied. |

| x. | costs incurred for Landlord’s general corporate overhead and general administrative expenses in an amount not to exceed $100,000.00 per calendar year in the aggregate. |

| 5 |

| xi. | costs associated with managing, repairing, maintaining, insuring or operating any parking structure including the cost of payroll for clerks, attendants and other persons, bookkeeping, parking insurance, parking management fees, tickets, striping and uniforms directly incurred in operating the parking garage in an amount not to exceed $85,000.00 per calendar year in the aggregate. |

Notwithstanding anything contained in this Lease to the contrary, "Operating Expenses" shall not include costs Landlord incurs or is charged for: (1) Taxes; (2) margin tax costs; (3) leasing, advertising, and promotional costs; (4) any rental and any associated costs, either actual or imputed, for the Landlord’s management or leasing office; (5) relocation or takeover expenses, including, without limitation, lease buy out costs and expenses incurred by Landlord with respect to any space in the Complex; (6) real estate brokerage commissions; (7) attorneys’ fees, other professional fees, entertainment expenses, listing fees, lease concessions and inducements, and other costs related to cleaning, showing, leasing, or making ready leasable space, demolition, construction, and related costs incurred in connection with the alteration and improvement of leasable space for, or in preparation for, occupancy; (8) any costs (including permit, license, and inspection fees) incurred in renovating, improving, decorating, painting, or redecorating leasable space for tenants or other occupants or in vacant space (including the cost of alterations or improvements to the Premises or to the premises of any other tenant or occupant of the Complex), and any cash or other consideration paid by Landlord on account of, with respect to, or in lieu thereof; (9) costs incurred to provide non-building standard goods, services, or other benefits to one or more tenants or occupants of the Building (other than Tenant) without reimbursement; (10) costs incurred to furnish goods and services to any other tenant or occupant to the extent Tenant would be required to pay or reimburse Landlord as a charge separate from, or in addition to, payment of Operating Expenses under the terms of this Lease; (11) costs incurred to provide goods, services, or other benefits to other tenants or occupants for which: (a) Landlord is entitled to reimbursement as an additional charge or rental over and above base rent (including any escalations); or (b) the other tenant or occupant is obligated to pay to a third-party; (12) costs incurred for Landlord’s general corporate overhead and general administrative expenses in excess of $ $100,000.00 per calendar year in the aggregate; (13) costs incurred for wages, salaries, bonuses and other compensation of any officer, executive, or employee of Landlord above the grade of building manager or property manager or for any off-site employees; (14) costs incurred to pay fees or dues, or to make cash or in-kind contributions, for political, charitable, industry association, or similar organizations; (15) costs associated with owning, managing, and operating the entity constituting Landlord, including, without limitation, all costs incurred for: (i) the entity’s tax and financial accounting (but not including the bookkeeping and accounting related to the Complex which shall be properly charged as Operating Expenses); (ii) legal services; (iii) prosecuting or defending any claims or lawsuits with any mortgagee (except to the extent Tenant’s acts or omissions are in issue); (iv) selling, syndicating, financing, mortgaging, or hypothecating Landlord’s interest in the Complex; and (v) disputes between Landlord and its employees, building managers, lenders, contractors, tenants, and other occupants (including Tenant, except as provided in Section 39, below); (16) costs incurred to buy or rent furniture and office equipment for Landlord’s management, security, engineering, or other offices of Landlord its leasing agents, management personnel associated with the Complex; (17) costs (other than routine maintenance costs) of any art work (such as sculptures or paintings) used to decorate the Complex; (18) all compensation paid to clerks, attendants, concierges, or other persons working in or managing commercial concessions operated by Landlord; (19) costs associated with managing, repairing, maintaining, insuring or operating any parking structure including the cost of payroll for clerks, attendants and other persons, bookkeeping, parking insurance, parking management fees, tickets, striping and uniforms directly incurred in operating the parking garage in excess of $85,000.00 per calendar year in the aggregate; (20) costs of installing or, to the extent operational costs exceed those normally incurred for providing general office space, the cost of operating any specialty service, such as an observatory, broadcasting facility, luncheon club, or athletic or recreational club; (21) costs incurred as a result of any breach of any contractual, statutory, tort, or other legal duty by Landlord or its agents to Tenant, to any other tenant, or to any third-party; (22) costs, penalties, and fines incurred by Landlord as a result of the violation by Landlord, or by any other tenant or occupant of the Complex, of Applicable Laws, except reasonable and necessary costs incurred in any successful contest of the alleged violation of Applicable Laws; (23) penalties, interest, or similar charges incurred as a result of any late payment by Landlord, including, without limitation, penalties for late payment of taxes, equipment leases, and other

| 6 |

amounts owed by Landlord to any third party; (24) payments to any parent, subsidiary, or affiliate of Landlord for services (other than the management fee), or for goods, supplies or other materials, to the extent that the costs of such services, goods, supplies, or materials exceed the cost that would have been paid had the services, goods, supplies or materials been provided by parties unaffiliated with Landlord; (25) contributions to operating expense reserves, tenant improvement reserves, leasing commission reserves, capital improvement reserves, or any other reserve; (26) legal, auditing, consulting and professional fees paid or incurred in connection with negotiations for financings, refinancings, sales, or exchanges of the Complex; (27) payments of principal, interest, defeasance charges, or other charges in connection with any loan secured, in whole or in part, by the Building or the Building and payment of rent under any ground lease; (28) depreciation, amortization, payments on any encumbrances on the Building and the cost of capital improvements or additions; (29) costs incurred to remediate mold or encapsulate, remove, or abate asbestos or hazardous substances present at the Complex as of the effective date of this Lease; (30) costs incurred to correct or repair defects in the construction or design of the Premises or the Complex, to replace any defective equipment or building system serving the foregoing; (31) costs of LEED certification and other green programs or initiatives (32) intentionally omitted; (33) any cost, charge, expense, or liability incurred by Landlord prior to, or which accrued prior to, the Effective Date except as expressly itemized on a schedule to this Lease; (34) Costs and expenses of alterations or capital improvements of the Premises or the premises of other tenants in the Complex; (35) Costs and expenses associated with the operation of the business of the person or entity which constitutes Landlord as the same are distinguished from the costs of operation of the Complex, including accounting and legal matters, costs of defending any lawsuits with any mortgagee (except to the extent the actions of Tenant or any other tenant may be in issue), costs of selling or financing any of Landlord's interest in the Complex and outside fees paid in connection with disputes with other tenants; (36) Legal fees, space planner's fees, real estate brokers' commissions, leasing commissions paid to others and advertising expenses incurred in connection with the original or future leasing of space in the Complex; or (37) any costs paid to Landlord or Landlord’s affiliates for management services that are in excess of the market rates for management services of comparable quality rendered by persons or entities of similar skill, competence and experience.

Landlord and Tenant also agree that Operating Expenses will be "net" only and, for this purpose, Operating Expenses will be reduced by the amounts of any reimbursement, recoupment, payment, discount, credit, reduction, allowance or the like received by Landlord, or to which Landlord is, or may be, entitled, in connection with such operations, including, without limitation: (i) the amount of any discount or rebate given to Landlord or any affiliate of Landlord for goods or services included in Operating Expenses ; (ii) reimbursements received for repairs, replacements, general maintenance, or other Operating Expenses under insurance policies, warranties, or other contracts (including tenant leases); and (iii) any revenue from concessions operated by Landlord (e.g., snack bar).

J. Examination of Books. Upon reasonable prior notice, Tenant, at its expense, shall have the right during business hours to examine Landlord's books and records relating to Operating Expenses for the Complex for a calendar year in question, for a period of one year following the end of said calendar year. In the event Tenant’s examination reveals Landlord overstated Tenant’s Share in an amount equal to or greater than five percent (5%), Landlord shall pay to Tenant, within thirty (30) days after receipt of an invoice therefor from Tenant, Tenant’s costs and expenses incurred in the performance of said audit. Notwithstanding, if Tenant does not audit Landlord’s books and records within one year following the end of a calendar year, Tenant’s right to audit the Operating Expenses shall lapse and the Operating Expenses shall be deemed final and conclusive for all previous periods, except for the then current year.

K. Survival of Obligation. Tenant's obligation to pay Operating Expenses during the Term of this Lease shall survive following any termination of this Lease, and Landlord's obligation to refund overpayments to Tenant, shall survive until the later of: (1) one year following the end of the calendar year in which the Operating Expenses were paid; and (2) any audit timely commenced under Subsection 4(J), above.

| 7 |

L. Demand; Time. Each of the foregoing amounts of Rent shall be paid to Landlord without demand and without deduction, set-off or counterclaim on the first (1st) day of every month during the Term of this Lease (except for the Basic Rent Abatement pursuant to Section 4.C, the abatement, if any, in the event that the Outside Deadline is not met pursuant to Section 3.A, and the Basic Rent Rebate, if applicable, under Section 4.N, and any abatement to which Tenant is entitled under Section 50). If Landlord shall at any time or times accept Rent after it shall become due and payable, such acceptance shall not excuse a delay upon subsequent occasions, or constitute, or be construed as a waiver of any or all of Landlord's rights hereunder.

M. Payment of Rent and Additional Rent. In addition to and not in limitation of any other rights and remedies which Landlord may have in case of failure by Tenant to pay any sum of Additional Rent when due, such non-payment shall entitle Landlord to the remedies available to it hereunder for non-payment of Rent. All such charges or expenditures shall be paid to Landlord, at the office of the Landlord, or to such other party or to such other address as Landlord may designate from time to time by written notice to Tenant. Any unpaid Basic Rent or Additional Rent shall accrue interest thereon at the rate of fifteen percent (15%) per annum commencing thirty (30) days after the date it is due. Any Basic Rent or Additional Rent not paid within fifteen (15) days of the date it is due shall be subject to a late charge of five percent (5%) of the unpaid amount to cover the administrative costs of the late payment.

N. Basic Rent Rebate. Notwithstanding anything herein to the contrary, provided that the Lease is then in effect and that no Event of Default has occurred and is in effect, Landlord hereby agrees to rebate to Tenant the sum of Seventy Thousand and No/100 Dollars ($70,000.00) not later than thirty days after each of the first seven anniversaries of the Lease Commencement Date (each and collectively, the "Basic Rent Rebate"). For example, in connection with the previous sentence, if the first anniversary of the Lease Commencement Date is February 1, 2023, Tenant would be entitled to a rebate of Seventy Thousand and No/100 Dollars ($70,000.00) on March 2, 2023. If Landlord terminates this Lease prior to the initial Lease Expiration Date due solely to the default of Tenant hereunder, then as part of the recovery set forth in Section 16 of the Lease, Landlord shall be entitled to the recovery of the total of the Basic Rent Rebate(s) that were rebated to Tenant under the provisions of this Section 4.N. If Tenant is entitled to the foregoing Basic Rent Rebate, but Landlord does not furnish same in a timely manner, Tenant may deduct that year's Basic Rent Rebate from the succeeding month's payment(s) of Basic Rent, until the Basic Rent Rebate for that year has been expended.

| 5. | UPKEEP OF PREMISES; UPKEEP OF COMPLEX |

Except for any obligation of Landlord with respect to the Premises, Tenant will keep the Premises and fixtures and Tenant's equipment therein in clean and safe condition, will take good care thereof, will suffer no waste or injury thereto, and will at the expiration or other termination of the Term of this Lease, surrender the same broom clean in the same order and condition in which they are on the Lease Commencement Date, ordinary wear and tear, casualty, condemnation, and other unavoidable damage excepted. All injury to the Premises or the Complex of which they are a part, caused by moving property of Tenant's into, in or out of said Complex and all breakage done by Tenant, or the agents, servants, employees, and visitors of Tenant shall be repaired by Tenant at expense of Tenant. In the event Tenant shall fail to do so, then Landlord shall have the right to make such reasonably necessary repairs, alterations and replacements, structural or otherwise and any charge or cost so reasonably incurred by Landlord shall be paid by Tenant with the right on the part of Landlord to elect in its discretion to regard the same as Additional Rent, in which event, such cost or charge shall become Additional Rent payable with the installment of Rent next becoming due or thereafter falling due under the terms of this Lease.

| 8 |

Landlord shall pay for and make the following repairs as and when reasonably necessary and shall keep all Common Areas and Complex systems in good order, condition, and repair (subject to the right to charge any tenants of the Complex for any portion of same that are Operating Expenses defined above): (1) structural repairs to the Premises and Common Areas; and (2) repairs required in order to provide any services to be furnished by Landlord pursuant to this Lease (including with respect to the Common Areas); and (3) repairs to the windows and roof of the Premises. If a repair which is Landlord's responsibility is necessitated by an act or omission of Tenant or its agents, Landlord shall make the repair, and Tenant shall reimburse Landlord promptly for the cost of the repair. Tenant shall promptly notify Landlord of any condition needing repair which is Landlord's responsibility under this Section and to which Tenant has actual knowledge. Tenant, at its sole cost and expense, shall maintain in good order, condition and repair, all portions of the Premises not specifically designated as Landlord’s duty in this paragraph, including but not limited to the HVAC, plumbing, wiring, glazing, interior doors, floors, ceilings, interior walls and the interior surface of exterior walls, fixtures, lighting, fire protection and alarm systems, equipment and signs. Provided that such activities are Operating Expenses within the terms and conditions of this Lease, Tenant shall reimburse Landlord for the foregoing as part of Tenant's payments of Additional Rent, subject to the terms thereof.

| 6. | MECHANIC'S LIENS |

If any mechanic's or materialmen's lien is filed against the Premises, the Complex and/or the land for work claimed to have been done for, or materials claimed to have been furnished to Tenant or its subtenants (except for work performed by or at the request of Landlord in furtherance of Landlord's obligations under this Lease), such lien shall be discharged by Tenant within thirty (30) days after the Tenant receives written notice of such lien, at Tenant's sole cost and expense by the payment thereof or by filing any bond required by Applicable Law. If Tenant shall fail to discharge any such mechanic's or materialmen's lien, Landlord may, at its option, discharge the same and treat the cost thereof as Additional Rent payable with the monthly installment of Rent next becoming due; it being hereby expressly covenanted and agreed that such discharge by Landlord shall not be deemed to waive or release the default of Tenant in not discharging the same. It is further understood and agreed that in the event Landlord shall give its written consent to Tenant's making any such Alterations (as defined below) pursuant to Section 7 below, such written consent shall not be deemed to be an agreement or consent by Landlord to subject Landlord's interest in the Premises, the Complex or the land to any mechanic's or materialmen's liens which may be filed in respect of any such Alterations made by or on behalf of Tenant.

| 7. | TENANT ALTERATIONS |

A. Alterations. Landlord shall construct all of the Lease Improvements and Tenant Improvements, as defined in Exhibit “C”. Landlord shall pay an amount not to exceed Two Million Three Hundred and Sixty-Three Thousand Two Hundred Fifty and No/100 Dollars ($2,363,250.00) for the Tenant Improvements (the "Landlord Cap"). Tenant shall pay the cost of the Tenant Improvements in excess of the Landlord Cap, if any. Any costs of the Tenant Improvements over the Landlord Cap will, at the request of Tenant, up to One Million Five Hundred and Seventy-Five Thousand Five Hundred and No/100 Dollars ($1,575,500.00), be funded by Landlord and the amount shall be amortized over the Term at an interest rate of 0% per annum and such amortization amount shall be included by Tenant as a payment to Landlord along with the monthly Basic Rent payment (the "TI Deferred Payment"). The Lease Improvements and Tenant Improvements shall be performed by Landlord in accordance with Exhibit "C" attached hereto. Tenant will not make or permit anyone to make any material alterations, decorations, additions or improvements, structural or otherwise, in or to the Premises or the Complex, without the prior written consent of Landlord ("Alterations"), which shall not be unreasonably withheld, delayed, denied, or conditioned. All of such Alterations must conform to all applicable rules and regulations established from time to time by the Underwriters' Association of the local area and conform to all applicable requirements of the Federal, state and local governments, including any requirements or approvals set forth in Section 50 of this Lease. When granting its consent, Landlord may impose any conditions it deems reasonably appropriate, including, without limitation, approval of plans and specifications, selection of contractor and obtaining of specified insurance, provided the foregoing conditions are reasonable in nature.

| 9 |

B. Property of Landlord. All alterations, installations, changes, replacements, attached equipment, laboratory casework, built-in cabinet work sinks and related plumbing fixtures, laboratory benches, exterior venting fume hoods, additions to, or improvements in, including wall-to-wall carpet, upon the Premises (whether with or without the prior written consent of Landlord) shall, at the election of the Landlord (which election Landlord shall deliver in writing to Tenant at least 120 days prior to the expiration of the Term; and, if Landlord does not timely deliver such election to Tenant, Landlord will be deemed to have elected to waive its rights to designate property to be retained under this Section 7.B), remain upon the Premises, become property of the Landlord, and be surrendered with the Premises at the expiration or termination of this Lease or upon expiration of any renewal period hereof without disturbance, molestation or injury; provided, however, that if Tenant is not then in default in the performance of any of its obligations under this Lease, Tenant shall have the right (but not the obligation) to remove, during the 90-day period prior to the Lease Expiration Date, any of the foregoing items which Landlord does not wish to retain (or which Landlord is deemed to have waived its right to retain), together with all of Tenant's movable furniture, movable furnishings, or movable equipment, or trade fixtures purchased by Tenant at its sole cost and expense and within the Premises, at the expense of Tenant. If Tenant elects to so remove any such items from the Premises, Tenant agrees to repair all material damage to the Premises and the fixtures, appurtenances and equipment of the Landlord therein, and to the Complex caused by the Tenant's removal of its furniture, fixtures, equipment, machinery and the like and the removal of any improvements or alterations. Should the Tenant fail to repair all the above referred to damage, then, and in such event, the Landlord may repair the said damage at the Tenant's expense and the Tenant hereby agrees to reimburse the Landlord for such expense within 10 business days follow receipt of demand therefor.

Notwithstanding anything contained in this Lease to the contrary, Tenant shall have the exclusive use of the furniture, fixtures and equipment (“FF&E”) as more particularly described in the Donation Agreement; the FF&E shall not be removed or used in another location (but may be removed by Tenant from the Premises in the same manner as other property which Tenant is entitled to remove under this Section 7.B during the final 90 days of the Term).

C. Indemnification. Tenant will indemnify and hold Landlord, Landlord's mortgagees, and their respective employees, agents, tenants, invitees, licensees, affiliates, partners, members, shareholders, and principals (each a "Landlord Indemnified Party" and collectively, the "Landlord Indemnified Parties") harmless from and against any and all losses, liability, expenses, liens, claims or damages (each, a “Loss”) to person or property which occur during the Term of this Lease as a direct result of Tenant's alterations, decorations, additions or improvements, including without limitation, the Tenant Improvements or any Alteration, except to the extent any such Loss is caused by Landlord’s breach of its maintenance obligations under Section 5 of this Lease or Landlord’s willful misconduct. If any such alteration, decoration, addition or improvement is made without the prior written consent of Landlord and such Alteration is not permitted under this Lease, Landlord may correct or remove the same, and Tenant shall be liable for any and all reasonable expenses incurred by Landlord in the performance of this work.

| 8. | SERVICES |

Landlord shall furnish to Tenant during the Term of the Lease hot and cold water, electric current adequate for Tenant's proposed use of the Premises, and sanitary sewer services at those points of supply up to the demarcation of the Premises as set forth on Plans and Specifications (as hereinafter defined). Notwithstanding the foregoing, Landlord shall not be liable for failure to furnish or for suspension or delay in furnishing any of such services under this Section 8 caused by breakdown that is outside of Landlord's reasonable control, maintenance or repair work (to the extent outside of Landlord's reasonable control) or strike, riot, civil commotion, natural disaster, or pandemic. If, however, Tenant is prevented from using, and does not use, the Premises or access thereto because of the unavailability of any such service for a period of three (3) consecutive business days and such unavailability was within Landlord’s reasonable control, then Tenant shall, as its exclusive remedy be entitled to abatement of Basic Rent and Additional Rent for each day that Tenant is so prevented from using or accessing the Premises. Tenant shall be responsible for obtaining its own separately metered electricity, telephone, internet, and other desired services.

| 10 |

| 9. | INSPECTION |

Tenant will permit Landlord, or its agents or other representatives to enter the Premises with three (3) days written notice to Tenant except in the case of an emergency when Landlord may enter without notice and without charge therefor to Landlord and without diminution of the Rent payable by Tenant to examine, inspect and protect the Premises and the Complex and to make such alterations and/or repairs as in the judgment of the Landlord may be deemed reasonably necessary, or to exhibit the same to prospective tenants or purchasers during the Term of this Lease. Written notice shall include the names, employer, and purpose of the entry. Landlord acknowledges that the Premises must comply with various federal security requirements and that Tenant may prescribe additional requirements to comply with federal laws and maintain the integrity of the laboratory and other facilities within the Premises; Landlord shall comply with the foregoing at Tenant’s expense prior to entering the Premises.

| 10. | DAMAGE TO THE PREMISES OR COMPLEX |

If a portion of the Premises or Complex shall be damaged by fire or other cause (a "Casualty"), Landlord shall, within 60 days after such Casualty, deliver to Tenant a good faith estimate (the "Damage Notice") of the time needed to repair the damage caused by such Casualty use best efforts to repair such damage at the expense of the Landlord.

A. Tenant’s Rights. If the Premises or the Complex are damaged by Casualty such that Tenant is prevented from conducting its business in the Premises in a manner reasonably comparable to that conducted immediately before such Casualty and Landlord reasonably estimates that the damage caused thereby for which Landlord is responsible to repair under this Lease pursuant to Section 10.C below cannot be repaired within 270 days after the commencement of repairs (the "Repair Period"), then Tenant may terminate this Lease by delivering written notice to Landlord of its election to terminate within 30 days after the Damage Notice has been delivered to Tenant.

B. Landlord’s Rights. If a Casualty occurs and (1) Landlord estimates that the damage cannot be repaired within the Repair Period, (2) the damage exceeds 50% of the replacement cost thereof (excluding foundations and footings), as estimated by Landlord, and such damage occurs during the last two years of the Term, (3) regardless of the extent of damage, the damage is not fully covered by Landlord’s insurance policies or Landlord makes a good faith determination, after considering the availability of insurance proceeds, that restoring the damage would be uneconomical, or (4) Landlord is required to pay any insurance proceeds arising out of the Casualty to Landlord’s mortgagee, then Landlord may terminate this Lease by giving written notice of its election to terminate within 30 days after the Damage Notice has been delivered to Tenant.

C. Repair Obligation. If neither party elects to terminate this Lease following a Casualty, then Landlord shall, within a reasonable time after such Casualty, begin to repair the Premises and shall proceed with reasonable diligence to restore the Premises to substantially the same condition as they existed immediately before such Casualty; however, except for the Landlord Work, Landlord shall not be required to repair or replace any improvements, alterations or betterments within the Premises (which shall be promptly and with due diligence repaired and restored by Tenant at Tenant’s sole cost and expense) or any furniture, equipment, trade fixtures or personal property of Tenant or others in the Premises or the Complex, and Landlord’s obligation to repair or restore the Premises shall be limited to the extent of the insurance proceeds actually received by Landlord for the Casualty in question. Landlord shall be entitled to the full proceeds of the insurance policies providing coverage for all alterations, improvements and betterments in the Premises (and, if Tenant has failed to maintain insurance on such items as required by this Lease, Tenant shall pay Landlord an amount equal to the proceeds Landlord would have received had Tenant maintained insurance on such items as required by this Lease); for the avoidance of doubt, notwithstanding anything contained herein to the contrary, Tenant shall be entitled to the full proceeds of the insurance policies that Tenant maintains under Section 11.D, below.

| 11 |

D. Abatement of Rent. If the Premises are damaged by Casualty, Basic Rent and Additional Rent for the portion of the Premises rendered untenantable by the damage shall be abated on a reasonable basis from the date of damage until the earlier of (1) completion of Landlord’s repairs, (2) the date upon which completion of Landlord’s repairs would have occurred but for delays caused by Tenant Parties, or (3) the date of termination of this Lease by Landlord or Tenant as provided above, as the case may be, unless a Tenant Party caused such damage, in which case, Tenant shall continue to pay Basic Rent and Additional Rent without abatement. In the event that damage to the Premises or to the Complex is caused by the negligence or willful misconduct of Tenant or its agents, employees or invitees, any cost or expense reasonably incurred by Landlord to repair or restore the Premises or the Complex which is not covered by insurance shall be paid by Tenant, in which event such cost and expense shall become Additional Rent payable with the installment of Rent next becoming due under the Terms of this Lease.

| 11. | INSURANCE |

A. Insurance Rating. Except as permitted in Section 2, Tenant will not conduct or permit to be conducted, any activity, or place any equipment, material, chemical, fluid or substance outside of the Premises which will in any way increase the rate of fire insurance or other insurance on the Complex (unless the rate of fire insurance increases only with respect to the Premises and Tenant satisfies such increased premium); if any increase in the rate of fire insurance or other insurance is stated by any insurance company or by the applicable Insurance Rating Bureau to be due to any activity or equipment of Tenant in or about the Premises that is not permitted under this Lease (and the increase in the premium for such policy is not paid by Tenant under its policy), such statement shall be conclusive evidence that the increase in such rate is due to such activity or equipment and as a result thereof, Tenant shall be liable for such increase and shall reimburse Landlord therefor upon demand and any such sum shall be considered Additional Rent payable hereunder.

B. General Requirements. In all insurance policies carried by Tenant pursuant to the requirements of this Lease, Tenant shall name Landlord and Landlord's management agent, if any, as an additional insured, as their interests may appear, and shall contain an endorsement that such policy shall remain in full force and effect notwithstanding that the insured has waived his right of action against any party prior to the occurrence of a loss. Each policy shall contain an endorsement that will prohibit its cancellation prior to the expiration of thirty (30) days after notice of such proposed cancellation to Landlord. All such insurance policies shall be written as primary and non-contributory. Tenant shall provide Landlord with Certificates of Insurance evidencing the coverages required under this Lease prior to the occupancy and at least annually thereafter. Each policy shall be with a company or companies licensed to do business in the State of Texas and approved by Landlord and having a Best Rating of at least "A:VIII". Tenant shall promptly notify Landlord of the cancellation of any insurance required to be carried by Tenant hereunder. If Tenant fails to maintain any insurance required by this Section 11, Landlord may obtain such insurance, and any premium paid by Landlord shall be immediately payable by Tenant to Landlord as Additional Rent. Tenant shall require any permitted sublessee or assignee of the Premises pursuant to this Lease to comply with the requirements of this Section 11.

C. Liability Insurance. Throughout the term, Tenant shall carry commercial general liability insurance, including contractual liability, public liability and property injury, and products and completed operations liability, with limits of at least One Million Dollars ($1,000,000) per occurrence and Two Million Dollars ($2,000,000) aggregate for Tenant’s activities in the Premises, in a form providing occurrence basis coverage, in a form providing occurrence basis coverage.

D. Other Insurance. Tenant shall carry an all-risk policy of insurance covering any insurable interest that Tenant may have in the Premises or in any equipment serving the Premises, Tenant's leasehold improvements, trade fixtures, equipment and personal property kept at the Premises or elsewhere in the Complex, in an amount not less than the full replacement cost of such items. Tenant shall carry an umbrella insurance policy with limits of at least Five Million Dollars ($5,000,000) per occurrence and Five Million Dollars ($5,000,000) aggregate. Tenant shall obtain and maintain Worker’s Compensation insurance and Employer’s Liability coverage to cover obligations imposed by federal and state law covering all of Tenant’s employees, including statutory benefits outlined in the Texas Workers’ Compensation Act and minimum policy limits for Employer’s Liability of at least Two Hundred Fifty Thousand Dollars ($250,000) bodily injury per accident, Five Hundred Thousand Dollars ($500,000) bodily injury disease policy limit and Two Hundred Fifty Thousand Dollars ($250,000) per disease per employee.

| 12 |

E. Waiver of Subrogation. The Landlord and the Tenant each hereby waives its right of recovery against the other and each releases the other from any claim arising out of loss, damage or destruction to the Complex, Premises, or contents thereon or therein, to the extent its property is covered by a policy of insurance, whether or not such loss, damage or destruction may be attributable to the negligence of either party or its respective agent, visitor, contractor, servant or employee. Each policy shall include a waiver of the insurer's rights of subrogation against the party hereto who is not the insured under said policy.

F. Landlord’s Insurance.

| i. | Property Insurance. From and after the date of this Lease, Landlord will carry a policy or policies of all risk extended coverage insurance covering the Complex (excluding property required to be insured by Tenant) endorsed to provide replacement cost coverage and providing protection against perils included within the standard Texas form of fire and extended coverage insurance policy, together with insurance against sprinkler damage, vandalism, malicious mischief and such other risks as Landlord may from time to time determine and with any such deductibles as Landlord may from time to time determine, in its commercially reasonable discretion. |

| ii. | Commercial General Liability Insurance. Landlord will carry Commercial General Liability policy or policies covering the Complex against claims for personal or bodily injury, or death, or property damage resulting from the negligence of the Landlord or property manager or their agents, occurring upon, in or about the Complex to afford protection to the limit of not less than $2,000,000 per occurrence, and $2,000,000 annual aggregate or such limits and umbrella coverage as Landlord my determine in its commercially reasonable discretion. This insurance coverage shall extend to any liability of Landlord arising out of this Lease. |

| iii. | Other Requirements. Any insurance provided for in this Section 7.3 may be effected by a policy or policies of blanket insurance covering additional items or locations or assureds, provided that the requirements of this Section 7.3 are otherwise satisfied. Tenant shall have no rights in any policy or policies maintained by Landlord. |

| 12. | CONDEMNATION |

If all or a substantial part of the Premises (or use or occupancy of the Premises) shall be taken or condemned by any governmental or quasi-governmental authority for any public or quasi-public use or purpose (including sale under threat of such a taking), then the Term of this Lease shall cease and terminate as of the date when title vests in such governmental or quasi-governmental authority, and the Rent shall be abated on the date when such title vests in such governmental or quasi-governmental authority. If less than a substantial part of the Premises is taken or condemned by any governmental or quasi-governmental authority for any public or quasi-public use or purpose (including sale under threat of such a taking), Tenant may terminate this Lease only if, in its commercially reasonable opinion, its use of the Premises will be materially adversely affected by such taking. If this Lease does not terminate pursuant to the terms of this Section 12, the Rent shall be equitably adjusted (on the basis of the number of square feet of the Premises (and, as applicable, in the Complex) subject to the Lease before and after such event) on the date when title vests in such governmental or quasi-governmental authority and the Lease shall otherwise continue in full force and effect. Tenant shall have no claim against Landlord (or otherwise) and hereby agrees to make no claim against the condemning authority for any portion of the amount that may be awarded as damage as a result of any governmental or quasi-governmental taking or condemnation (or sale under threat of such taking or condemnation) for the value of any expired or unexpired Term of the Lease except for the cost of the portion of the Tenant Improvements made by and paid for by Tenant (it being understood and agreed that the portion of Tenant Improvements paid for by Tenant, for the purpose of allocating condemnation proceeds hereunder, shall not include the portion paid for by Landlord as part of the “Landlord Cap” or that portion of the TI Deferred Payment that has not been repaid to Landlord by Tenant; provided, however, that any recovery by Landlord of condemnation proceeds for Lease Improvements or Tenant Improvements

| 13 |

that were paid for by Landlord as part of the “TI Deferred Payment” shall relieve Tenant from repaying Landlord for such amounts that would have otherwise been due from Tenant to Landlord under Section 7A hereof), together with any payments made by Tenant to Landlord in connection with any modular structures placed on the Premises. Tenant may, if allowed by statute, also seek such awards or damages for moving expenses, loss of profits (provided that, with respect to recovery of loss of profits, that Landlord’s recovery is not diminished thereby) and fixtures and other equipment installed by it which do not, under the Terms of this Lease, become the property of the Landlord at the termination hereof. Such awards or damages must be made by a condemnation court or other authority and must be separate and distinct from award to Landlord and shall not diminish any award of the Landlord. For purposes of this Section 12, a substantial part of the Premises shall be considered to have been taken if more than fifty percent (50%) of the Premises are unusable by Tenant as a direct result of such taking.

| 13. | SIGNS |

Tenant has the right to erect signage on the Music Building and/or landscaped portion of the Common Area within or adjoining the Premises, subject to local ordinance, at Tenant’s sole cost and expense, and in accordance with those commercially reasonable specifications to be established by Landlord regarding signage within the Complex. If allowed by the Historic Design Review Commission, Tenant shall have the right to install a sign facing Houston Street and the plaza, provided that the design of same meets Landlord’s commercial reasonable sign specifications. Landlord shall have the right to prohibit any other advertisement of Tenant which in its reasonable opinion tends to impair the reputation of the Complex or its desirability as a high-quality Complex for offices, and upon written notice from Landlord, Tenant shall immediately refrain from and discontinue any such advertisement.

| 14. | HAZARDOUS MATERIALS |

Tenant shall not cause or knowingly permit any Hazardous Materials (as defined below) to be brought upon, kept or used in or about the Premises or the Complex in violation of Applicable Laws by Tenant or its employees, agents, contractors or invitees (collectively, “Tenant Parties”). Tenant shall indemnify, save, defend (at Landlord's option and with counsel reasonably acceptable to Landlord) and hold the Landlord Indemnified Parties harmless from and against any and all losses, liability, claims, damages, expenses and causes of action ("Claims") that are a direct result of the presence of any Hazardous Materials in, on, under or about the Complex, any portion thereof, or any adjacent property, to the extent caused by Tenant Parties. This indemnification by Tenant includes reasonable costs incurred in connection with any investigation of site conditions or any clean-up, remedial, removal or restoration work required by any governmental or quasi-governmental authority because of the foregoing breach by Tenant which caused Hazardous Materials to be present in the air, soil or groundwater above, on or under or about the Complex in a manner that violates Applicable Laws and which was above levels that were present prior to the Effective Date hereof. Without limiting the foregoing, if the presence of any Hazardous Materials in, on, under or about the Complex, any portion thereof, or any adjacent property, which is caused or knowingly permitted by Tenant results in any contamination of the Complex, any portion thereof or any adjacent property, then Tenant shall promptly take all actions at its sole cost and expense as are reasonably necessary to return the Complex, any portion thereof or any adjacent property to its respective condition existing prior to the time of such contamination (or, if such mitigation is not practicable, then to such level as is in compliance with Applicable Laws); provided that Landlord's written approval of such action shall first be obtained, which approval Landlord shall not unreasonably withhold.

| 14 |

A. Landlord acknowledges that it is not the intent of this Section to prohibit Tenant from operating its business for the use permitted by Section 2. Tenant may operate its business according to the custom of Tenant's industry, which includes the operation of a BSL-2 laboratory, so long as the use or presence of Hazardous Materials is strictly and properly monitored in accordance with Applicable Laws. As a material inducement to Landlord to allow Tenant to use Hazardous Materials in connection with its business, attached Exhibit "E" illustrates the substances the Tenant intends to have in the space during the term of the lease. Tenant agrees (a) this list identifying each type of Hazardous Material is to be present at the Premises that is subject to regulations under any environmental Applicable Laws, and may be updated periodically by Tenant; (b) a list of any and all approvals or permits from governmental or quasi-governmental authorities required in connection with the presence of such Hazardous Material shall be kept at or be made accessible from the Premises, and (c) correct and complete copies of (i) notices of violations of Applicable Laws related to Hazardous Materials and (ii) plans relating to the installation of any storage tanks to be installed in, on, under or about the Complex (provided that installation of storage tanks shall only be permitted after Landlord has given Tenant its written consent to do so, which consent Landlord may withhold in its sole and absolute discretion) and closure plans or any other documents required by any and all governmental or quasi-governmental authorities for any storage tanks installed in, on, under or above the Complex for the closure of any such storage tanks (collectively, "Hazardous Materials Documents") shall be provided to Landlord by Tenant pursuant to the following sentence. Tenant shall deliver to Landlord updated Hazardous Materials Documents (a) no later than thirty (30) days prior to the initial occupancy of any portion of the Premises or the initial placement of equipment anywhere at the Complex, (b) if there are any changes to the Hazardous Materials Documents, annually thereafter no later than December 31st of each year, and (c) thirty (30) days prior to the initiation by Tenant of any Alterations or changes in Tenant's business that involve any material increase in the types or amounts of Hazardous Materials. For each type of Hazardous Material listed, the Hazardous Materials Documents shall include (i) the chemical names, (ii) the material state (e.g., solid, liquid, gas or cryogen), (ii) the concentration, (iv) the storage amount and storage condition (e.g., in cabinets or not in cabinets), (v) the use amount and use condition (e.g., open use or closed use), (vi) the location (e.g., room number or other identification) and (vii) if known, the chemical abstract service number. Notwithstanding anything in this Section to the contrary, Tenant shall not be required to provide Landlord with any Hazardous Materials Documents containing information of a proprietary nature, which Hazardous Materials Documents, in and of themselves, do not contain a reference to any Hazardous Materials or activities related to Hazardous Materials. Landlord may, at Landlord's expense, cause the Hazardous Materials Documents to be reviewed by a person or firm qualified to analyze Hazardous Materials to confirm compliance with the provisions of this Lease and with Applicable Laws. In the event that a review of the Hazardous Materials Documents indicates non-compliance with this Lease or Applicable Laws, Tenant shall, at its expense, diligently take steps to bring its storage and use of Hazardous Materials into compliance.

B. Notwithstanding the provisions of this Section 14, if (a) Tenant or any proposed transferee, assignee, or sublessee of Tenant has been required by any prior landlord, lender, mortgagee, or governmental or quasi-governmental authority to take material remedial action in connection with Hazardous Materials contaminating a property if the contamination resulted from such party's action or omission or use of the property in question, or (b) Tenant or any proposed transferee, assignee or sublessee is subject to a material enforcement order issued by any governmental or quasi-governmental authority in connection with the use, disposal or storage of Hazardous Materials, then Landlord shall have the right to terminate this Lease in Landlord's sole and absolute discretion (with respect to any such matter involving Tenant), and it shall not be unreasonable for Landlord to withhold its consent to any proposed transfer, assignment, or subletting (with respect to any such matter involving a proposed transferee, assignee or sublessee).

| 15 |

C. At any time, and from time to time, prior to the expiration of the Term, Landlord shall have the right, at Landlord’s sole cost and expense, to conduct appropriate tests of the Complex or any portion thereof, including without limitation the Premises, to investigate whether Hazardous Materials are present or that contamination has occurred due to Tenant or Tenant's employees, agents, contractors or invitees. Notwithstanding the preceding sentence to the contrary, Tenant shall pay all reasonable cost of such test if such test reveals that Hazardous Materials exists at the Complex in violation of this Lease.

D. During the Term, Tenant shall promptly report to Landlord any actual or suspected presence of mold or water intrusion at the Premises of which Tenant obtains actual knowledge.

E. Tenant's indemnification obligations under this Section shall survive the expiration or earlier termination of the lease. During any period of time needed by Tenant or Landlord after the termination of this Lease to complete the removal from the Premises of any such Hazardous Materials, Tenant shall be deemed a holdover tenant and subject to the provisions of Section 17 below.

F. As used herein, the term "Hazardous Material" means any hazardous or toxic substance, material or waste that is or becomes regulated by any governmental or quasi-governmental authority.

| 15. | SURRENDER |

A. At least ten (10) days prior to Tenant's surrender of possession of any part of the Premises, Tenant shall provide Landlord with (a) a facility decommissioning and Hazardous Materials closure plan for the Premises ("Exit Survey") prepared by an independent third party reasonably acceptable to Landlord, (b) written evidence of all appropriate governmental releases obtained by Tenant in accordance with Applicable Laws, including laws pertaining to the surrender of the Premises, and (c) proof that the Premises have been decommissioned in accordance with American National Standards Institute ("ANSI" Publication Z9.11-2008 (entitled "Laboratory Decommissioning") or any successor standard published by ANSI or any successor organization (or, if ANSI and it successors no longer exit, a similar entity publishing similar standards). In addition, Tenant agrees to remain responsible after the surrender of the Premises for the remediation of any recognized environmental conditions (including without limitation, Hazardous Materials) set forth in the Exit Survey. Tenant's obligations under this Section shall survive the expiration or earlier termination of the Lease.

B. No surrender of possession of any part of the Premises shall release Tenant from any of its obligations hereunder, unless such surrender is accepted in writing by Landlord.

C. The voluntary or other surrender of this Lease by Tenant shall not effect a merger with Landlord's fee title or leasehold interest in the Premises or the Complex, unless Landlord consents in writing, which shall not be unreasonably withheld, delayed, denied, or conditioned, and shall, at Landlord's option, operate as an assignment to Landlord of any or all subleases. The voluntary or other surrender of any ground or other underlying lease that now exists or may hereafter be executed affecting the Complex, or a mutual cancellation thereof or of Landlord's interest therein by Landlord and its lessor shall not effect a merger with Landlord's fee title or leasehold interest in the Premises or the Complex.

| 16 |

| 16. | DEFAULT OF TENANT |

A. Events of Default. If Tenant shall (i) fail to pay any monthly installment of Rent (as required by Section 4 or any other provision of this Lease) as and when due or shall fail to timely make any other payment required by the terms and provisions hereof and such failure shall continue for a period of ten (10) days after Tenant receives written notice thereof from Landlord (provided that Landlord shall not be required to provide written notice thereof more than twice in any rolling 12-month period) or, if Landlord is not required to give such notice because it has already done so in a particular rolling 12-month period, and such failure continues for a period of ten (10) days after the due date thereof; (ii) violate or fail to perform any of the other terms, conditions, covenants or agreements herein made by Tenant (or in the Work Letter) and such other violation or failure shall continue for a period of ten (10) days after written notice thereof to Tenant by Landlord (or if such obligation is not reasonably capable of being performed within such 10-day period, if Tenant fails to commence the cure thereof and diligently pursue such cure); (iii) intentionally deleted; or (iv) make or consent to an assignment for the benefit of creditors or a common law composition of creditors, or a receiver of Tenant's assets is appointed, or Tenant files a voluntary petition in any bankruptcy or insolvency proceeding, or an involuntary petition in any bankruptcy or insolvency proceeding is filed against Tenant and not discharged by Tenant within one hundred twenty (120) days, or Tenant is adjudicated a bankrupt, then in any of the foregoing events (each, an "Event of Default"), Landlord shall be entitled to elect from the following remedies:

| i. | Landlord may terminate this Lease by giving Tenant written notice thereof, in which event this Lease and the leasehold estate hereby created and all interest of Tenant and all parties claiming by, through or under Tenant shall automatically terminate upon the effective date of such notice. If Landlord elects to so terminate this Lease, everything contained in this Lease on the part of Landlord to be done and performed shall cease without prejudice, however, to the right of Landlord to recover from Tenant all Rent and any other sums accrued up to the time of termination or the date on which Tenant actually vacates the Premises, whichever is later. |

Should Landlord terminate this Lease due to an Event of Default, Landlord may elect, as its sole remedy: (i) to accelerate the Basic Rent due hereunder to the end of the Term hereof, discounted to present value at a per annum rate equal to eight percent (8%), minus the then-present fair rental value of the Premises for such period, similarly discounted; (ii) to recover possession of the Premises, by force, summary proceedings, or otherwise or (iii) to relet the Premises for such Rent and upon such terms as are not unreasonable under the circumstances and, Tenant shall be liable for all direct, out of pocket damages sustained by Landlord, including, without limitation, deficiency (if any) in Basic Rent between what Tenant was obligated to pay as Basic Rent under this Lease and the basic rent actually collected by Landlord, reasonable attorneys' fees incurred by Landlord against Tenant, brokerage fees, and expenses of removing Alterations that were not approved by Landlord and reasonable expenses of placing the Premises in rentable condition that comparable with that which existed on the Effective Date.

| 17 |

| ii. | Landlord may terminate Tenant’s right to possession of the Premises and enjoyment of the rent, issues and profits therefrom without terminating this Lease or the leasehold estate created hereby, re-enter and take possession of the Premises and remove all persons and property therefrom with or without process of law, without being deemed guilty of any manner of trespass and without prejudice to any remedies for arrears of Rent or existing breaches hereof, and lease, manage and operate the Premises and collect the rents, issues and profits therefrom all for the account of Tenant, and credit to the satisfaction of Tenant’s obligations hereunder the net rental thus received (after deducting therefrom all reasonable costs and expenses of repossessing, leasing, managing and operating the Premises). Tenant shall continue to remain liable to Landlord for all obligations under this Lease, including without limitation, the Rent (subject to any offset for reletting). If the net rental so received by Landlord exceeds the amounts necessary to satisfy all of Tenant’s obligations under this Lease, nevertheless Landlord shall retain such excess. If Landlord elects to proceed under this Section, it may at any time thereafter elect to terminate this Lease as provided in Section 16Ai. Any damage or loss of Rent sustained by Landlord may be recovered by Landlord at the time of an Event of Default, or at Landlord's option, at the time of the reletting, or in separate actions, from time to time, as said damage shall have been made more easily ascertainable by successive relettings, or, at Landlord's option, may be deferred until the expiration of the Term of this Lease, in which event Tenant hereby agrees that the cause of action shall not be deemed to have occurred until the date of expiration of said Term. Landlord shall use commercially reasonable efforts to mitigate its damages resulting from an Event of Default. However, provided that Landlord uses commercially reasonable efforts to relet the Premises, in no event shall Landlord be liable for failure to so lease, manage or operate the Premises or collect the rentals due under any subleases and any such failure shall not reduce Tenant’s liability hereunder. |

B. Waiver. If, under the provisions hereof, Landlord shall institute proceedings against Tenant and a compromise or settlement thereof shall be made, the same shall not constitute a waiver of any other covenant, condition or agreement herein contained, nor of any of Landlord's rights hereunder, except to the extent covered by such settlement. No waiver by Landlord of any breach of any covenant, condition or agreement herein contained shall operate as a waiver of such covenant, condition or agreement itself, or of any subsequent breach thereof. No payment by Tenant or receipt by Landlord of a lesser amount than the monthly installment of Rent herein stipulated shall be deemed to be other than on account of the earliest stipulated Rent, nor shall any endorsement or statement on any check or letter accompanying a check for payment of Rent be deemed an accord and satisfaction, and Landlord may accept such check or payment without prejudice to Landlord's right to recover the balance of such Rent or to pursue any other remedy provided in this Lease. No re-entry by Landlord, and no acceptance by Landlord of keys from Tenant, shall be considered an acceptance or a surrender of the Lease.